Earlier this week, my friend David Tswamuno posted on LinkedIn highlighting some of the best early-stage investments he’s made over his career.

If you know David, you can probably guess he wasn’t talking about buzzy startups or splashy acquisitions

These investments were in his siblings. He helped them get to the U.S., supported them through school, encouraged them through setbacks. He backed their lives before there were resumes to brag about.

Investing in people is obviously different then venture capital.

No pitch decks. No cap tables. Just time, belief, presence.

His points about backing the person for the long term, recognizing that answers are "on the field," and his "no one left behind" philosophy could have come directly from my own playbook.

It's a stark contrast to a venture world obsessed with quick wins and scalable formulas.

The Part No One Breaks Down

Venture capital has dissected the science of investing to death.

Market sizing. Moats. Growth loops. Funnels. Motions.

The jargon is endless, the frameworks meticulously crafted. But the art of early-stage investing?

That gets hand-waved as "intuition" or "pattern recognition," treated like some mystical talent possessed by the chosen few. Nobody really breaks it down.

I think the art is empathy.

And before you dismiss this as soft-skill nonsense, let me explain why emotional attunement might be the most overlooked alpha in venture.

The tech world has a deep discomfort with non-quantifiable skills. Everyone obsesses over TLAs that promise to distill real world phenomena down to something that can drive a financial model. KPIs, OKRs, DPI, IRR, CAC, LTV.

We crave these data points, these frameworks that promise to de-risk the inherently human endeavor of building something new. But in that obsession, we risk missing the most critical variable: the person. The founder. The team. We risk missing subtle human signals that often predict success or failure more accurately than any spreadsheet.

Accidental Alpha

I didn’t realize I was investing until years after I’d already started doing it.

In community college, I met a driven freshman named Holly Stiebel. On paper, she didn’t look like someone who was going to be a banker.

When I was in her shoes, neither did I.

But I saw in her the potent combination of raw, curious ambition that reminded me of the unbridled energy I had when I was sitting in the same seat at Santa Monica College.

Together, we started WACC (Wall St. After Community College), a program that I am incredibly proud of and absolutely changed the direction of my life for the better.

It wasn’t sophisticated. We didn’t have funding or a five-year plan. But we had urgency.

We just saw this massive gap between the kids who knew how the finance world worked and the rest.

At community college, we realized that some of our smartest peers were effectively excluded from the industry because no one had ever explained to them what in the world they actually do “on Wall Street.”

This had nothing to do with intelligence or effort. They simply didn’t speak the language. They didn’t have the guidebook. And no one was offering to show them the way.

Through building WACC, I watched Holly grow in real time.

She took ownership. She started mentoring others. And I began to see what I loved most: finding people with something burning inside them and helping them translate it into motion.

That wasn’t mentorship. That was investment. I just didn’t know to call it that.

I wasn’t writing checks. I was underwriting ambition. I was betting on someone’s trajectory before it calcified. Before they even believed it was real. I was getting proximate, asking better questions, offering scaffolding, creating space. And then stepping back.

It took me a while to realize I had already stumbled into the real work of venture capital long before I got the job title.

The work of identifying overlooked talent, seeing past the noise, and helping someone build toward the version of themselves the world hadn’t caught up to yet.

The Spark

I constantly get asked where the reflex to start Daring Ventures came from. I wish I could say that it came naturally.

I had actually seen it modeled long before WACC existed.

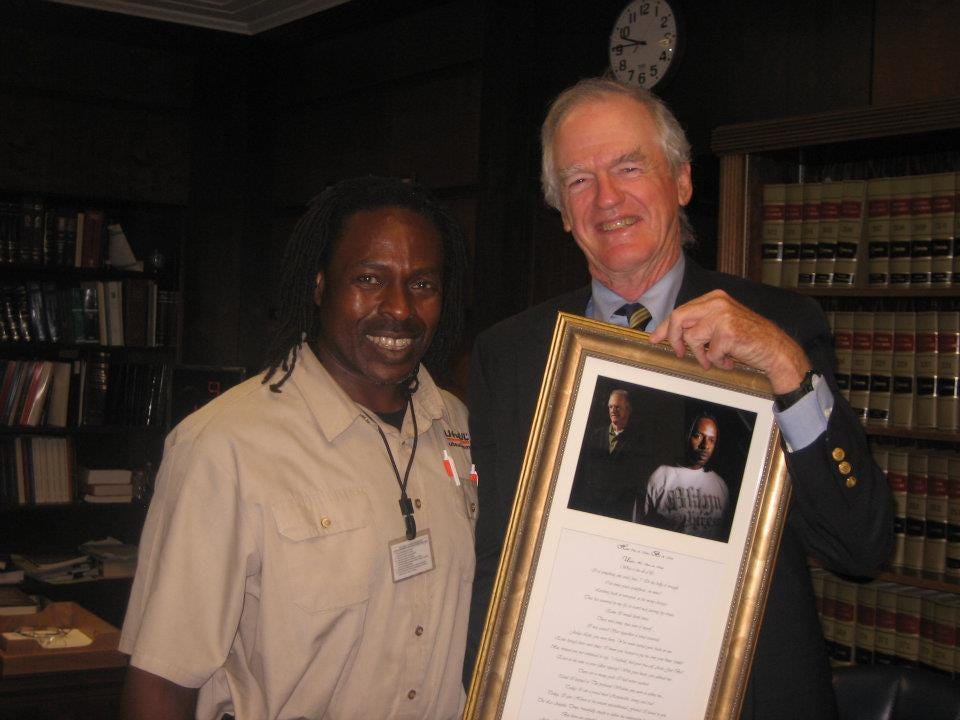

My grandfather showed me what it looked like to truly invest in people. He never framed it that way. But that’s exactly what he did.

He left behind a lucrative legal career to serve as a federal judge because he believed in a different kind of return. Not one measured in dollars, but in dignity. In systems made slightly more fair. In people who were seen, sometimes for the first time.

One story has stayed with me.

The LA Times profiled how, well into his seventies, he walked the streets of Skid Row with a photograph in his hand, searching for a man that had been caught up in the punitive machinery of mandatory minimums, sentenced to decades for a nonviolent drug offense.

“Twenty-five years, no guarantee of ever leaving, for that amount of cocaine?

I took the case on appeal because it just rubbed me the wrong way.”

My grandfather didn’t just disagree with the law. He fought it. And he didn’t fight it from afar. He got close. He showed up. He searched for the man himself.

That wasn’t grandstanding. That wasn’t about legacy. It was personal. He believed in redemption. He believed some people were worth fighting for even when the world had already moved on. He believed the system could be bent back toward justice if you were stubborn enough to keep pushing.

I used to think his greatest strength was his mind. Over time, I realized it was his presence. His refusal to look away. His capacity to believe in people even when it made no sense on paper.

So when I think about WACC now, I see it for what it really was. Not an experiment or side project.

It was the moment I started following his lead. I wasn’t trying to be a founder. I was trying to live up to the example he set.

And in doing so, I was learning the craft of investing the same way he had taught it.

Quietly. Relationally. Through belief.

Spidey Sense Is Real

Eventually I began to realize I had developed a sense. Not a sixth sense. Not magic. But a kind of radar. A way of picking up on things others missed.

Most people in this business call it pattern recognition. I’ve always hated that term. Because what they really mean is pattern familiarity.

Does this person look like the others who succeeded? Did they go to the right school, work at the right company, speak with the right cadence?

What I learned instead was how to recognize a different kind of pattern.

Not polish, but promise. Not pedigree, but drive. Not confidence, but conviction.

The kind that hums beneath the surface. That hasn’t been trained or tamed yet.

You don’t learn to spot that in pitch meetings. You learn it in the in-between moments. That’s where the real signals live. Not in a spreadsheet. In the silences. The hesitations. The little bursts of clarity wrapped in self-doubt.

That’s where I’ve always been most comfortable. Not being the expert. Being the mirror. Asking the questions that make someone realize they’ve known the answer all along.

It’s slow. It’s messy. It doesn’t scale neatly. But it’s real. And it’s the only way I know how to find the people I want to back.

Edge Isn’t What You Think

The best investors I’ve met aren’t the ones who talk the most in partner meetings. They’re the ones who can read the room before the conversation even starts. They notice the pauses.

They sense the unspoken tension between co-founders. They feel the shift in energy when a founder brings up the real reason they’re building.

This isn’t softness. This is strategic acuity. It’s the ability to pick up on the things that no one’s saying but everyone’s feeling. It’s the capacity to hold someone’s ambition in one hand and their insecurity in the other and not flinch.

That is the edge.

Because early-stage investing is rarely about validating the obvious. If it were obvious, someone else would have done it already.

The job is to perceive the hidden. To notice the potential before it congeals. To see the inner architecture of someone’s ambition and decide whether it’s strong enough to support the weight of a company, a team, a movement.

You don’t get that from a data room. You get that from presence. From being willing to sit with ambiguity. From resisting the impulse to look for answers when what’s needed is better questions.

That’s what I learned building WACC. That’s what my grandfather showed me in every case he took personally. And that’s what I’m still practicing now. Not as a philosophy. As a skill. As a discipline. As the real, often invisible work of investing.

Pedigree is Overrated

The loudest rooms in tech still worship at the altar of pedigree. They talk about founder-market fit as if it's a precise formula. But some of the best founders I've backed didn't "look the part."

Their pitches weren't smooth. Sometimes they sounded like raw tension, like individuals still wrestling with the enormity of their vision.

They were compelling not because of polish but because of undeniable substance and fierce clarity of nascent conviction.

We built Daring Ventures to find those people. Not because it's charitable. Because it's alpha. We aim to underwrite ambition that others miss, often because we consciously speak the human language of resilience, grit, and nuanced motivation that many VCs ignore or simply don't know how to decipher.

This might mean looking at different data points, spending more time understanding a founder's "why," or valuing lived experience as much as pedigreed resumes.

The Quiet Portfolio

Here's the thing about true investment in people. If you're still the hero in someone's story years later, if your name is constantly invoked as the reason for their success, you weren't truly investing. You were performing. Building your own legend on their efforts.

True empathy doesn't watermark. It doesn't leave an indelible brand. It nourishes, supports, challenges, then steps aside. It lets others own the light, claim their victories, learn from their mistakes. The greatest return is their independence, their self-authorship.

The Real Work

So here's my ask. Take inventory of your quiet portfolio.

Who showed up for you when they didn't have to?

Who offered not just tangible help but that invaluable currency of belief?

And who are you doing that for now?

Who are you showing up for, not for attribution or personal brand, but because you see a spark and understand this is the real work?

Joe Alalou is a co-founder and General Partner at Daring Ventures, a pre-seed fund investing in software that amplifies uniquely human skills in complex, relationship-driven fields.

If you enjoyed this, please share or subscribe!